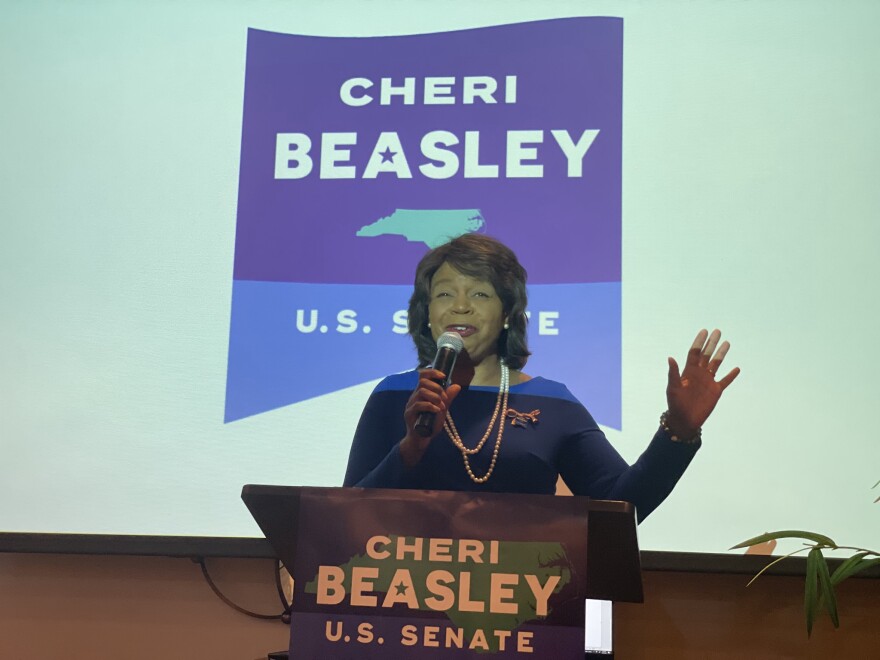

It’s time for our weekly fact check of North Carolina politics. This week, we’re looking at a new ad in this year’s U.S. Senate race between Republican Ted Budd and Democrat Cheri Beasley. The ad makes claims Beasley is in favor of increasing taxes on families that make under $75,000.

To find out if that's true, "Morning Edition" host Marshall Terry talks to Paul Specht of WRAL.

Marshall Terry: First Paul, who is behind this ad?

Paul Specht: The advertiser behind this one is Senate Leadership Fund, and that's a Republican-backed political action committee. You often hear them referred to as PACs, and they're a pretty big group, often trying to help Republican candidates all over the country who are trying to win Senate seats.

Terry: All right. So is that claim we heard a moment ago, that Beasley wants to raise taxes on families making under $75,000, is that true?

Specht: Not exactly. Now, what this is referring to is the Inflation Reduction Act, but touched on a lot of things, from corporate taxes to green energy and stuff like that. (President Joe) Biden signed it into law back in August. It does not change the federal tax rate for anyone making $75,000 a year or less. It doesn't change the rate for anyone making $400,000 a year or less. Now, what this refers to is the trickle-down effects of it.

A bunch of different groups looked at how might this affect employees and people out there through the various different things in this bill. Right? And one thing they looked at would be how will corporations pass along the cost of these higher taxes to their employees, to investors and things like that.

There was a committee in Congress that looked at the trickle-down effect and they found that the tax burden would be shifted onto taxpayers to the tune of about 1%. And in the case of people making $75,000 a year, about half a percent. But we're not done there. That study itself by that congressional committee was not comprehensive. It looked at how the taxes on corporations might trickle down. It did not look at other parts of the bill. For instance, it did not take into consideration health care subsidies for people on the Affordable Care Act and health care insurance plans.

There's one group called the Committee for a Responsible Federal Budget. It's not actually a congressional committee. It's a nonprofit. But they reported that those subsidies for ACA plans, also known as Obamacare plans, would be, "more than enough to counter the net tax burden increases for anyone making below $400,000 a year." So, there are different ways to look at how this legislation, the Inflation Reduction Act, would affect people. But what we found was the effects would mostly be either small, delayed or net neutral.

Terry: So how does the Senate Leadership Fund, the Republican-backed group behind this ad, justify this claim against Beasley? Do they have evidence they cite?

Specht: Well, they cited that one congressional committee that just looked at how the tax hikes on the corporations would be passed along. And, you know, that tends to happen with lower returns for investors or lower wages for workers. And that's been out there. In fact, it's Republicans across the country have used it as sort of the source to make similar attacks against other Democrats running for office.

Terry: What’s Beasley’s response to this claim?

Specht: First, we went back and looked, does Beasley support the Inflation Reduction Act? And it's obvious that she does. Back when it was voted on in early August, she tweeted that it would definitely help lower costs across America and that any vote against this legislation was, "inexcusable." And she criticized North Carolina Sens. Thom Tillis and Richard Burr for their votes against it.

When we reached out about the ad specifically, her campaign cited news articles and fact checks not just from PolitiFact, but from other groups like the Associated Press and Bloomberg and New York Magazine, showing that, no, the tax rate does not change on paper. When people go do their taxes next year, they will not see a different federal income tax rate change as a result of this bill. What these articles looked at was whether or not there would be any effect on people who make $75,000 a year or less. And there are a bunch of groups out there that try to estimate the indirect effects on people. Committee for Responsible Budget, the Tax Foundation, University of Pennsylvania has a budget modeling calculator. And what they all found was that the effect of this legislation on people indirectly would be to the tune of about 1% or less. And, that means that their take-home pay would be affected 1% or less, or it would be net neutral by one study, or it would be delayed several years.

And obviously, a lot of things can change with the economy in three to five years. So we found that the effects of this bill on people making $75,000 or less would be almost negligible or delayed.

Terry: How did you rate the claim made in this ad?

Specht: We rated this mostly false. What that means is it's not totally false. It has a kernel of truth, meaning that there are estimates out there showing that the Inflation Reduction Act would have indirect small effects on people making $75,000 or less. But there's just so much context missing. There are other estimates that the legislation wouldn't affect those people at all, even indirectly. So that's why we ended up with them mostly false.

Copyright 2022 WFAE. To see more, visit WFAE. 9(MDAzNzE4NjE2MDEyNDcxNzIzNTk2MDZlOQ004))