North Carolina Insurance Commissioner has scheduled a public hearing for May to review the North Carolina Rate Bureau’s proposal to raise dwelling insurance rates by an average of 68.3% statewide.

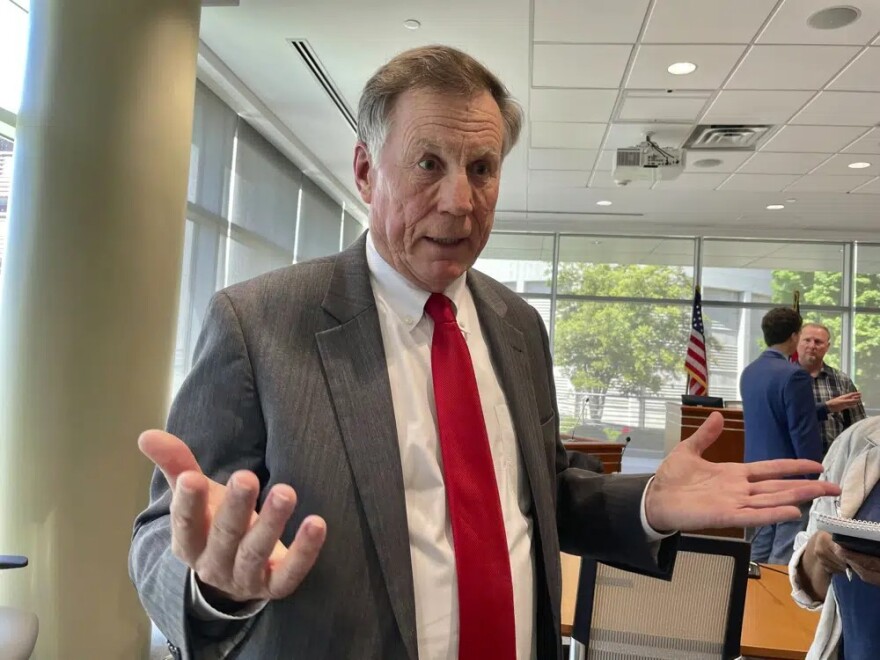

Commissioner Mike Causey made it clear he disagrees with the proposed hike, calling the hearing a necessary step toward a fair solution for residents and insurers.

“We are not in agreement with the Rate Bureau’s proposed increases filed earlier this fall,” said Commissioner Causey. “The next step, according to statute, is to set a hearing date. It is now necessary to schedule a hearing in order to work toward a resolution that will make the most financial sense for our residents and insurance companies.”

The hearing will be held at the Department of Insurance in Raleigh, unless a settlement is reached beforehand. State law gives the commissioner 45 days after the hearing to make a decision, and the Rate Bureau can choose to appeal.

Causey said the proposed increase would significantly impact rental homes, investment properties, and other non-owner-occupied dwellings.

North Carolina Rate Bureau Chief Operating Officer Jarred Chappell said setting a hearing is a normal part of this process, and the Rate Bureau will work with the Department of Insurance toward a fair rate approval.

Inflation in the construction industry has significantly increased repair and replacement costs in recent years, and Chappell said highly destructive storms are becoming more common - 2023 and 2024 saw a record number of billion-dollar disasters in the United States.

"North Carolina’s insurance rates must reflect increasing costs so that companies will want to write policies here and compete on price. Those prices are constrained by the rate-setting process, but final premiums are set property-by-property by individual carriers, based on risk," he explained, "The number of insurance carriers writing dwelling policies in North Carolina has fallen in recent years: From 85 companies to about 65."

The current rate-setting process only affects dwelling policies, which generally cover rental properties and vacation homes. Primary homes are covered by homeowners’ policies and will not be affected.

The last Rate Bureau request in 2023 sought a 50.6% increase but was negotiated down to 8%.

**This story has been edited to add comments from the North Carolina Rate Bureau Chief Operating Officer